A shrinking economy. Rising mortgage rates. Flatlining prices.

If you’re thinking about buying a home in 2025, you’re not alone in feeling uncertain. Many buyers are in wait-and-see mode—hesitating, watching the headlines, and wondering if now is the right time.

And the headlines are LOUD.

The Bureau of Economic Analysis just reported a 0.3% drop in GDP in Q1 2025, a sharp contrast to the 2.4% gain at the end of 2024. That kind of economic signal makes people pause.

But smart buyers aren’t sitting idle. They’re asking better questions. They’re studying the data. And they’re making a plan.

A Simple 3-Step Plan for Buying in 2025

If you’re unsure about making a move, here’s a practical, pressure-free way to think through your decision.

Step 1: Name the Real Concern

Most hesitant buyers are saying some version of:

“I think I just want to wait and see what happens with the economy. I don’t want to make a mistake.”

That’s understandable. But general fear doesn’t lead to clarity. Try breaking it down:

- Are you worried about mortgage rates?

- Unsure about your job stability?

- Concerned prices might drop after you buy?

Once you name the actual fear, you can look at it objectively—and that makes it easier to weigh your options and take action with confidence.

Step 2: Know What the Market Is Actually Doing

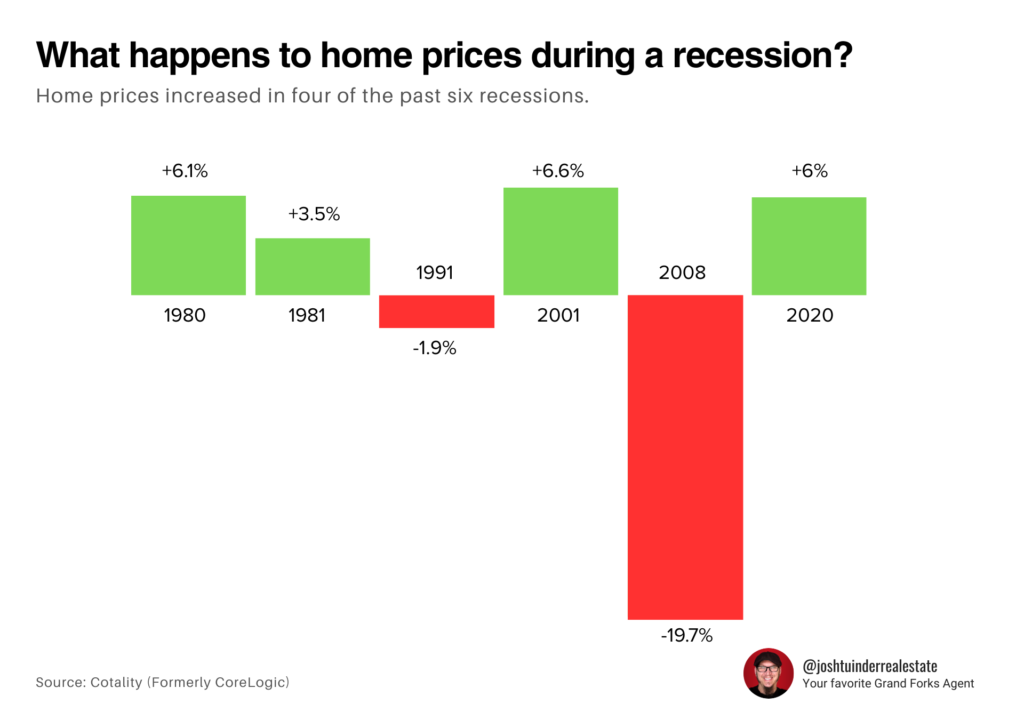

There’s a common myth that in every recession, housing prices collapse. But that’s not supported by the data. In fact, in four of the last six recessions, home prices actually went up.

And today’s market? It’s shifting—but not crashing.

According to Realtor.com’s April 2025 housing report:

- Inventory is up 30.6% year-over-year. More homes. Less competition.

- 18% of listings had price reductions. That’s the highest for any April since 2016. Sellers are adjusting.

- Homes are taking longer to sell. Median days on market is 50—up four days from last year.

- Prices are stable. The national median list price is $431,250. Price per square foot is up just 1.1%.

So no, this isn’t 2008. It’s a slower, more balanced market—one that gives thoughtful buyers more breathing room and opportunity.

Zooming In:

In Grand Forks, there are currently 112 homes for sale, reflecting a slight decrease from this time last year.

The average days on market is 92 compared to 106 last year, indicating that homes are selling more quickly compared to earlier months.

Approximately 17.8% of homes have experienced recent price reductions, suggesting that sellers are adjusting to current market conditions.

These local trends are crucial. Even amidst national economic uncertainties, real estate remains inherently local, and understanding the Grand Forks market dynamics can provide valuable insights for potential buyers.

Step 3: Build a Smart Plan

If you’re thinking about buying in the next 18 months, you have two solid paths:

- Option 1: Rent for 6–12 more months, save aggressively, and track the market.

- Option 2: Explore today’s listings and see if you can buy while others are hesitating.

There’s no one right answer. But there is a right process: getting informed, staying flexible, and moving when the time is right for you.

Bottom Line

The economy may be cooling, but that doesn’t mean you have to freeze.

In times like these, smart moves come from clear thinking—not panic. Stay grounded in data, focused on your long-term goals, and open to opportunities others might miss.

Ready to stop guessing and start planning?

Let’s talk about your goals, your timeline, and what makes sense for you in today’s market. Whether you’re buying in 3 months or 13, a smart plan starts with a real conversation.

Sources: Realtor.com, bea.gov,

Join The Discussion