What Really Happens to Home Prices During a Recession?

Every time the word recession hits the headlines, uncertainty follows—especially if you’re thinking about buying or selling a home.

You’re probably asking:

- Are home prices going to crash?

- Will mortgage rates shoot up?

- Should I wait to make a move?

All fair questions. And you’re definitely not alone. The good news? We don’t have to guess—we can look to history.

Let’s break it down.

A Recession ≠ A Housing Crash

First, a myth worth busting:

A recession doesn’t automatically mean home prices tank. That assumption is mostly driven by memories of 2008—but that was a very specific and extreme scenario.

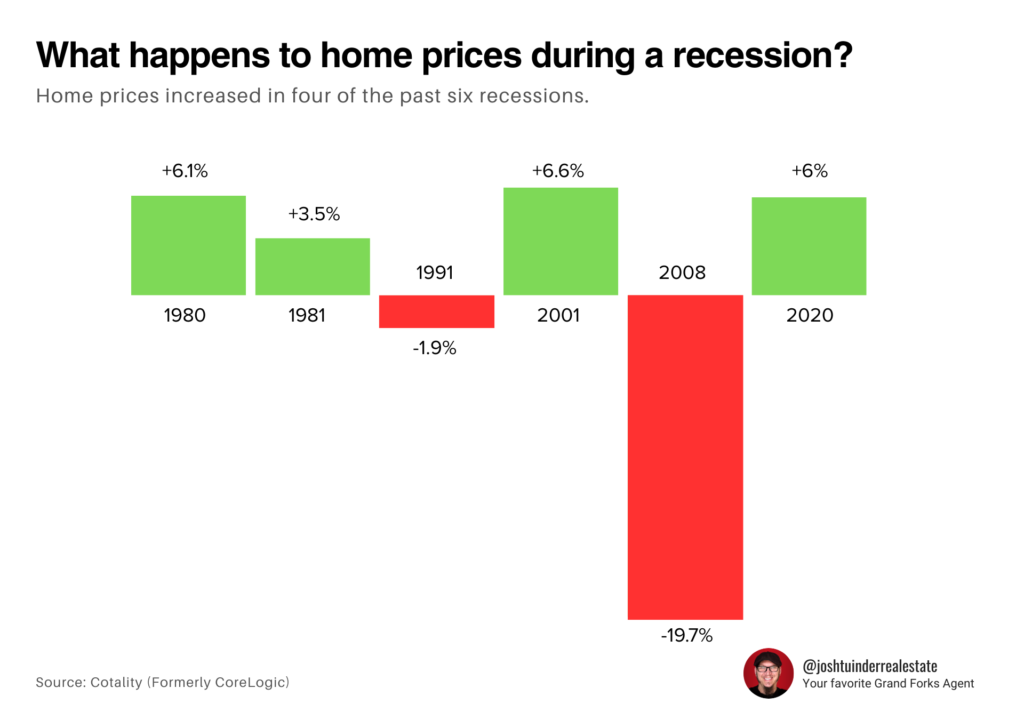

Let’s look at the numbers: In 4 of the last 6 U.S. recessions, home prices actually increased. In another, they dipped only slightly—less than 2%. That leaves just one major drop, and it happened during the Great Recession of 2008. But that downturn wasn’t just a typical economic slowdown. It was a housing-led financial crisis caused by a perfect storm of high-risk mortgage lending, loose credit standards, massive overbuilding, and widespread speculation. In other words, it was the housing market itself that triggered the recession.

That’s not what we’re seeing today. Lending standards are much tighter, inventory is low, and most homeowners are financially stable with significant equity. So while the word “recession” might raise alarms, it doesn’t mean we’re headed for a housing crash. History actually suggests the opposite.

So What Does Happen?

- Home prices often slow down—not crash.

- Fewer buyers enter the market, but that doesn’t mean prices collapse.

- Real estate is local. Inventory and demand vary by region, and so do price trends.

Mortgage Rates Usually Drop in a Recession

Here’s some good news for buyers:

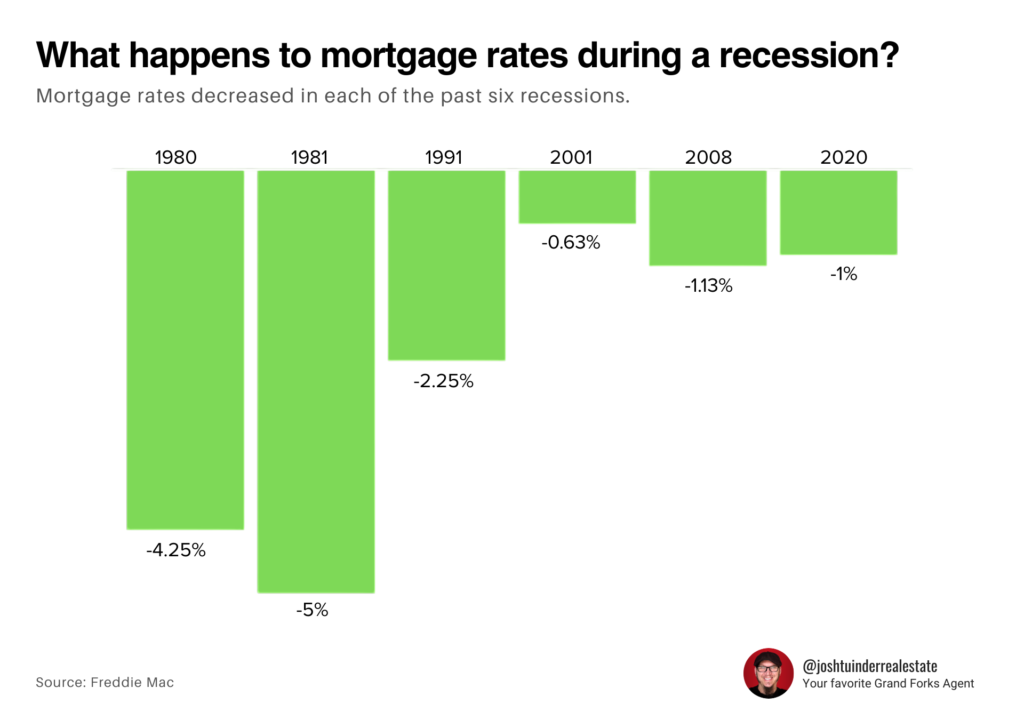

Mortgage rates tend to fall during recessions. That might sound surprising, but it’s backed by data.

According to Freddie Mac, mortgage rates declined during every U.S. recession over the past four decades. This isn’t a coincidence. When the economy slows down, the Federal Reserve often steps in to lower the federal funds rate in an effort to stimulate growth. Lower interest rates can help encourage borrowing, investing, and consumer spending—which includes home buying.

As a result, mortgage rates typically follow suit. That means financing a home often gets more affordable during a downturn, not less.

Now, let’s be realistic: We’re unlikely to see a return to the record-low 3% rates of 2020 and 2021. But even a modest drop—say, from 7% to 6%—can lead to significant savings over the life of a mortgage. For many buyers, that can mean hundreds of dollars less per month and greater long-term affordability.

So while a recession can feel like a time to hold back, for buyers with stable finances, it could actually be a smart window of opportunity.

Today’s Homeowners Are in a Stronger Position

This isn’t 2008. One major reason? Home equity.

The housing crash in 2008 was fueled by a wave of foreclosures and forced sales. That’s not the situation today—and a big part of the difference is equity.

Over the past several years, home prices have climbed steadily, and most homeowners have benefited from that appreciation. As a result, they’ve built up substantial equity, which acts like a financial cushion. According to analysis from Realtor.com using Federal Reserve data:

- Even if home prices dropped 10%, the average homeowner would still retain nearly 70% equity—about where things stood in 2021.

- A 20% price drop would bring equity levels back to 2019, before the pandemic housing boom. Still solid.

- And get this: More than half of U.S. homeowners (54%) have mortgage rates below 4%, which means they’re in no hurry to sell or refinance.

What does all that mean? Unlike in 2008, most homeowners today aren’t overleveraged. They’re not sitting on risky loans or struggling to make payments. In fact, many are in strong financial positions and would rather stay put than sell at a loss.

That’s why we’re unlikely to see a flood of distressed sales or foreclosures. And without that kind of sudden inventory surge, home prices are more likely to stay stable, even if the broader economy slows down.

Bottom Line

Recessions bring uncertainty, but the housing market doesn’t follow a one-size-fits-all script. History shows:

- Home prices often hold steady—or even rise

- Mortgage rates typically go down

- Today’s homeowners are in a much stronger financial position than in 2008

If you’re weighing whether to buy or sell, ignore the fear and focus on the facts. Let’s talk about what makes sense for you—not just the headlines.

Join The Discussion